Jobs Ratio Ranking

Eligible projects applying in the Tax Credit Program are reviewed according to the project’s jobs ratio. The jobs ratio ranking is statutorily mandated process to identify projects which are most likely to increase jobs and economic activity in the state.

Ranking

Applicants’ jobs ratios are ranked within the same project category: New/Recurring TV, Relocating TV, Feature Films, and Independent Films over and under $10m.

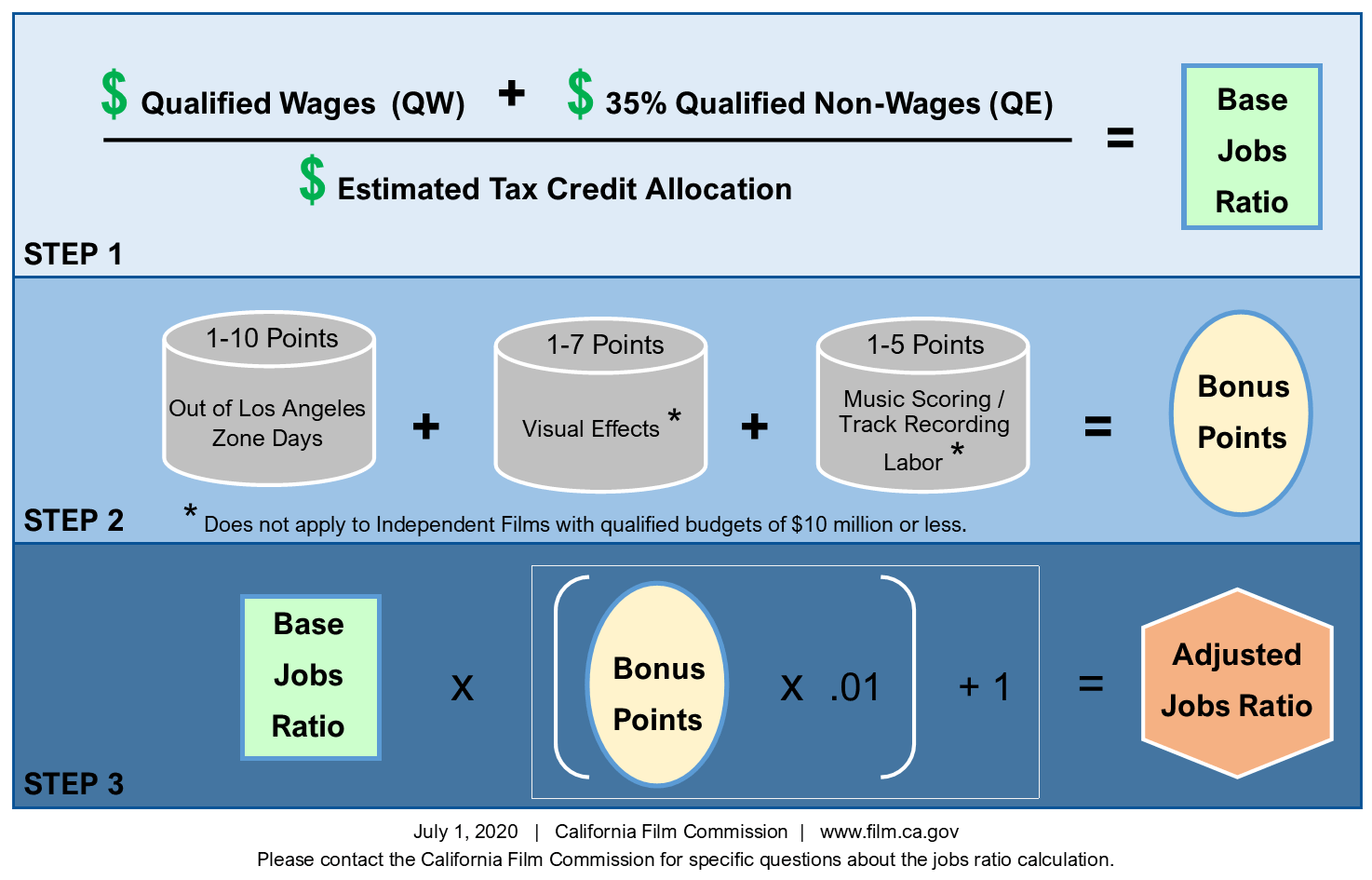

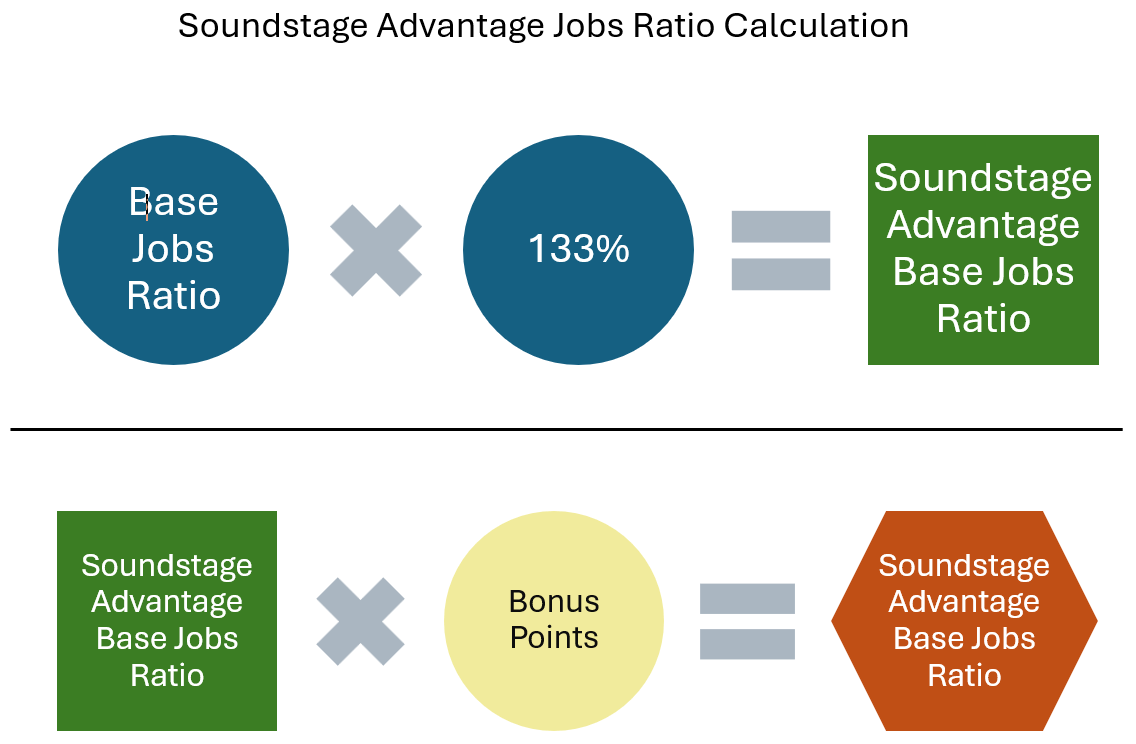

Base Jobs Ratio

The first calculation in the formula involves adding the qualified wages to 35% of the qualified expenditures. That sum is divided by the estimated tax credit amount.

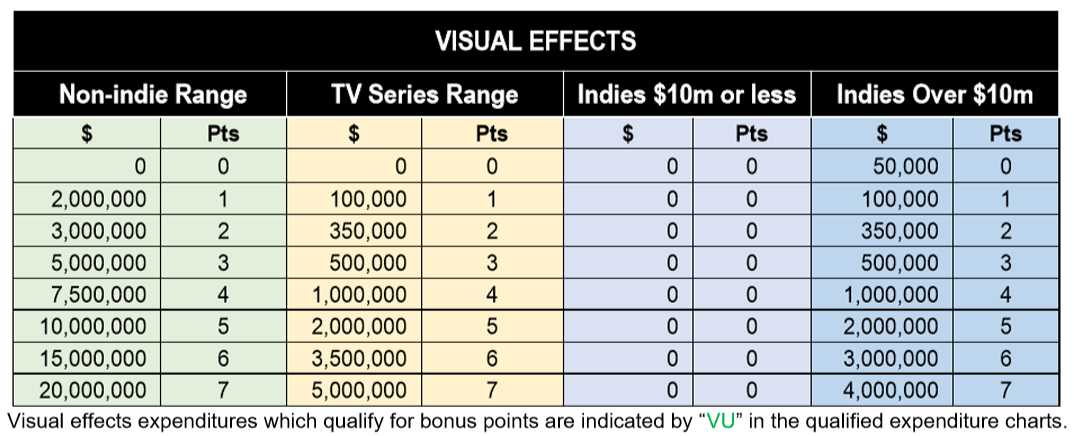

Bonus Points

The base jobs ratio may be increased based on activities in three areas: out-of-zone filming, visual effects spend, and music labor expenditures.

Adjusted Jobs Ratio

The final calculation used to determine a project’s ranking as compared to other like categories is known as the adjusted jobs ratio.

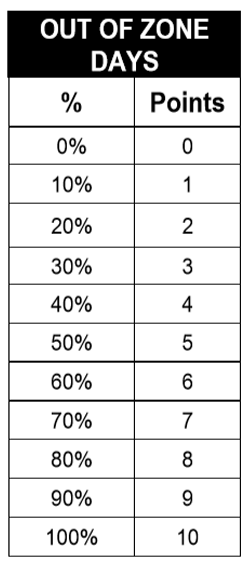

Out-of-Zone Filming

Bonus Points are determined by the percentage of principal photography days outside the Los Angeles 30-mile zone in relation to total principal photography days in-state.

- Bonus Points only apply to filming original photography (principal photography and reshooting original footage) OZ.

- If principal photography day is split between in- and out-of-zone locations, in order for the day to be considered as OZ, the first scene of the day must be shot in the out-of-zone location.

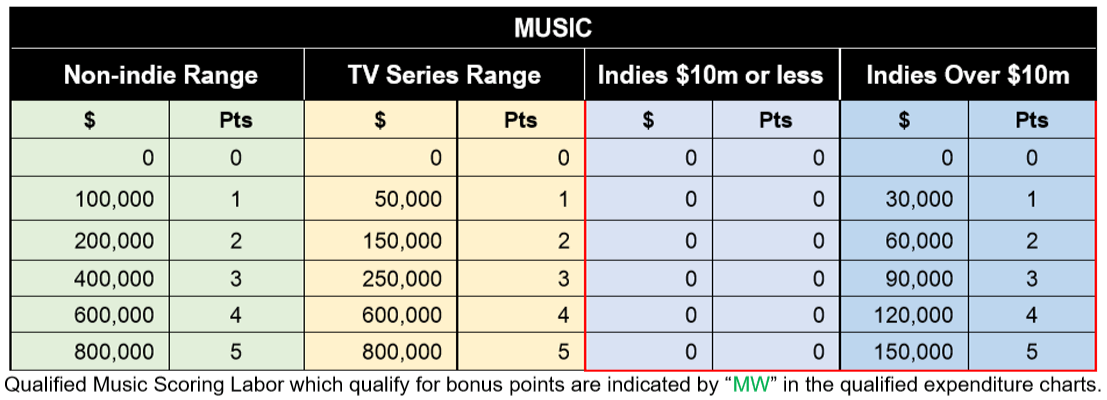

Music Scoring / Track Recording Labor

Bonus points apply to music Scoring/Track recording wages paid to scoring musicians, including the following positions: Instrumental musicians, vocalists, music arrangers, orchestrators, Musical Instrument Digital Interface (MIDI) transcribers, music copyists, music librarians, conductors (unless also composer), and musician and choral contractors employed solely for the purpose of recording music for the project.

How a Project is Ranked

Applications are ranked within categories based upon their jobs ratio score.

- The Film Commission determines the amount of tax credits available for each category prior to each application period.

- A list of finalists is determined for each category once the application period closes.

- This list includes those projects that would be selected (based on their jobs ratio score) if the allocation of tax credits for the category was double (or 200%) the predetermined amount.

- The Film Commission references these finalists as “the top 200% projects.”

- These projects advance to “Phase II” of the selection process for further evaluation.

- When Phase II process is complete (about 3 weeks), the highest ranked projects (top 100%) receive a Credit Allocation Letter indicating the amount of tax credits reserved.

- Remaining projects in Phase II are placed on the waitlist according to their jobs ratio score.

- The waitlist expires when the next allocation period for the same category begins.

California Film Commission

7080 Hollywood Blvd., Suite 900

Los Angeles, CA 90028

Tel: 323.860.2960 | 800.858.4749

Email the CFC | About Us

Stay Informed! Sign Up:

Newsletters

Production Alerts

Soundstage Alerts

CFC Board Notices Sign-Up

Careers

Download the Cinemascout app!