The Basics

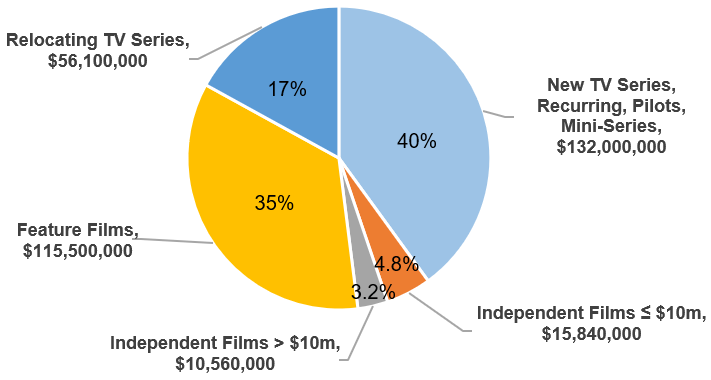

The California Film Commission administers the Film & Television Tax Credit Program 3.0 which provides tax credits based on qualified expenditures for eligible productions that are produced in California. The $1.55 billion program runs for 5 years, with a sunset date of June 30, 2025. Each fiscal year – July 1 to June 30 – the $330-million funding is categorized in: TV Projects, Relocating TV, Indie Features, and Non-Indie Features.

%

Non-Transferable Tax Credit

Relocating TV Series

Relocating Television Series (any episode length) that filmed its most recent season (minimum 6 episodes) outside California. $1 million minimum budget per episode. Credit is reduced to 20% after the first season filmed in California.

%

Transferable Tax Credit

Independent Films

Independent Films: $1 million minimum budget. Credits apply only to the first $10 million of qualified expenditures.

%

Non-Transferable Tax Credit

Feature Film, New TV Series, Mini-Series, Pilots

Feature Film: $1 million minimum budget. Credit allocation applies only to the first $100 million in qualified expenditures, plus uplifts.

New television and Mini-series for any distribution outlet: $1 million minimum budget per episode (at least 40 minutes per episode, scripted only).

TV Pilots: $1 million minimum budget (at least 40 minutes).

%

Credit Uplift

Out-of-Zone Filming, Visual Effects, Local Hire Labor

Eligible projects may receive an additional 5% or 10% credit for the following expenditures:

Out-of-Zone Filming: Expenditures relating to original photography and incurred outside the 30-Mile Studio Zone (pre-production through strike). Eligible expenditures include qualified wages paid for services performed outside the Zone, and expenditures purchased or leased and used outside the Zone.

Visual Effects: To qualify, visual effects work must represent at least 75% of the VFX budget or a minimum of $10 million in qualified VFX expenditures incurred in California.

Local Hire Labor: Non-independent productions (except for Relocating TV) are eligible to receive an additional 10% tax credit for qualified local hire labor. Independent films and relocating TV series are eligible to receive an additional 5% tax credit for qualified local hire labor.

%

Non-Transferable Tax Credit

Relocating TV Series

Relocating Television Series (any episode length) that filmed its most recent season (minimum 6 episodes) outside California. $1 million minimum budget per episode. Credit is reduced to 20% after the first season filmed in California.

%

Transferable Tax Credit

Independent Films

Independent Films: $1 million minimum budget. Credits apply only to the first $10 million of qualified expenditures.

%

Non-Transferable Tax Credit

Feature Film, New TV Series, Mini-Series, Pilots

Feature Film: $1 million minimum budget. Credit allocation applies only to the first $100 million in qualified expenditures, plus uplifts.

New television and Mini-series for any distribution outlet: $1 million minimum budget per episode (at least 40 minutes per episode, scripted only).

TV Pilots: $1 million minimum budget (at least 40 minutes).

%

Credit Uplift

Out-of-Zone Filming, Visual Effects, Local Hire Labor

Eligible projects may receive an additional 5% or 10% credit for the following expenditures:

Out-of-Zone Filming: Expenditures relating to original photography and incurred outside the 30-Mile Studio Zone (pre-production through strike). Eligible expenditures include qualified wages paid for services performed outside the Zone, and expenditures purchased or leased and used outside the Zone.

Visual Effects: To qualify, visual effects work must represent at least 75% of the VFX budget or a minimum of $10 million in qualified VFX expenditures incurred in California.

Local Hire Labor: Non-independent productions (except for Relocating TV) are eligible to receive an additional 10% tax credit for qualified local hire labor. Independent films and relocating TV series are eligible to receive an additional 5% tax credit for qualified local hire labor.

When Can I Apply?

Eligible productions may submit an application via the online application portal during specific application windows.

When Can I Apply?

Eligible productions may submit an application via the online application portal during specific application windows.

Jobs Ratio Ranking

Submitted applications are approved via a Jobs Ratio Ranking – a process to identify projects most likely to increase jobs and economic activity in the state.

Jobs Ratio Ranking

Submitted applications are approved via a Jobs Ratio Ranking – a process to identify projects most likely to increase jobs and economic activity in the state.

How do I apply as an Indie Producer?

Several resource materials, including Frequently Asked Questions, are available to independent and non-independent applicants.

How do I apply as an Indie Producer?

Several resource materials, including Frequently Asked Questions, are available to independent and non-independent applicants.

California Film Commission

7080 Hollywood Blvd., Suite 900

Los Angeles, CA 90028

Tel: 323.860.2960 | 800.858.4749

Email the CFC | About Us

Stay Informed! Sign Up:

Newsletters

Production Alerts

Soundstage Alerts

CFC Board Notices Sign-Up

Careers

Download the Cinemascout app!