The Basics

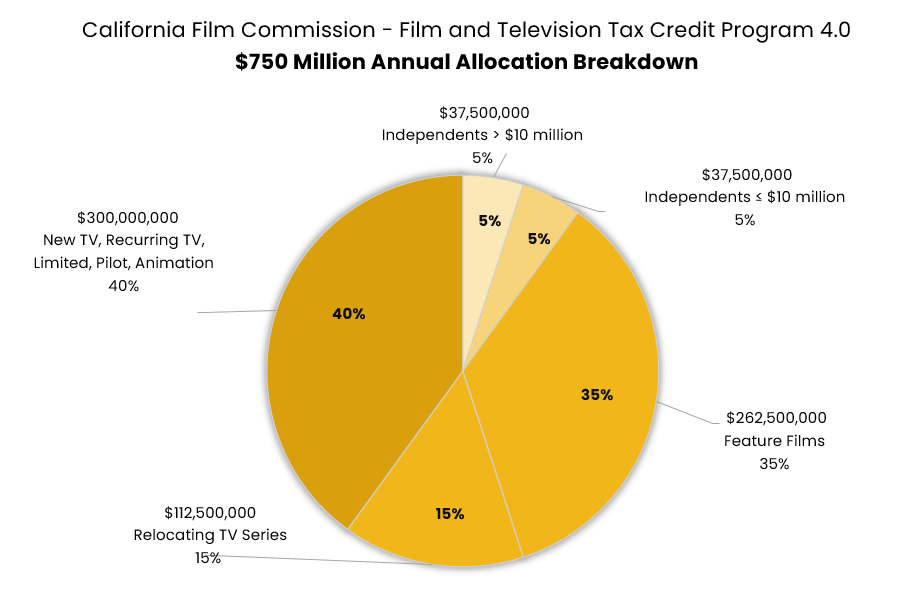

The California Film Commission administers the Film & Television Tax Credit Program 4.0 which provides tax credits based on qualified expenditures for eligible productions that are produced in California. The $3.75 billion program runs for 5 years, with a sunset date of June 30, 2030. Each fiscal year – July 1 to June 30 – the $750-million funding is categorized in: TV Projects, Relocating TV, Indie Features, and Non-Indie Features.

%

Refundable/Non-Transferable Tax Credit

Relocating TV Series

Relocating Television Series (any episode length) that filmed its most recent season (minimum 6 episodes) outside California. $1 million minimum budget per episode. Credit is reduced to 35% after the first season filmed in California.

%

Refundable Tax Credit / Transferable Tax Credit

Independent Films

Independent Films: $1 million minimum budget. Credits apply only to the first $20 million of qualified expenditures.

%

Refundable/Non-Transferable Tax Credit

Feature Film, New TV Series, Mini-Series, Pilots

Feature Film: $1 million minimum budget. Credit allocation applies only to the first $120 million in qualified expenditures, plus uplifts.

New television and Mini-series for any distribution outlet: $1 million minimum budget per episode (at least 20 minutes per episode, scripted only).

TV Pilots: $1 million minimum budget (at least 20 minutes).

%

Credit Uplift

Out-of-Zone Filming, Visual Effects, Local Hire Labor

Eligible projects may receive additional tax credits for the following expenditures:

Out-of-Zone Filming:

Non-Independent projects and all Television projects (except for Relocating TV) may receive an additional 5% for qualified expenditures related to original photography outside the LA Zone (pre-production through strike). These include qualified wages paid for services performed outside the Zone, items purchased or leased and used exclusively outside the Zone, and a prorated amount of items purchased or leased outside the Zone and used BOTH outside and inside the Zone.

Visual Effects:

Non-Independent projects and all Television projects (except for Relocating TV) may receive an additional 5% for qualified visual effects expenditures. To be eligible, the VFX work in CA must represent EITHER 75% or more of the total worldwide VFX expenditures OR a minimum of $10 million in qualified California VFX expenditures.

Local Hire Labor:

All Non-Independent and Independent projects (except for Relocating TV) series are eligible to receive an additional 10% tax credit for qualified wages paid to CA residents who reside outside the LA Zone, for work performed outside the LA Zone.

Relocating TV series are eligible to receive an additional 5% tax credit for such wages.

%

Refundable/Non-Transferable Tax Credit

Relocating TV Series

Relocating Television Series (any episode length) that filmed its most recent season (minimum 6 episodes) outside California. $1 million minimum budget per episode. Credit is reduced to 35% after the first season filmed in California.

%

Refundable Tax Credit

Independent Films

Independent Films: $1 million minimum budget. Credits apply only to the first $20 million of qualified expenditures.

%

Refundable/Non-Transferable Tax Credit

Feature Film, New TV Series, Mini-Series, Pilots

Feature Film: $1 million minimum budget. Credit allocation applies only to the first $120 million in qualified expenditures, plus uplifts.

New television and Mini-series for any distribution outlet: $1 million minimum budget per episode (at least 20 minutes per episode, scripted only).

TV Pilots: $1 million minimum budget (at least 20 minutes).

%

Credit Uplift

Out-of-Zone Filming, Visual Effects, Local Hire Labor

Eligible projects may receive an additional 5% or 10% credit for the following expenditures:

Out-of-Zone Filming: Expenditures relating to original photography and incurred outside the 30-Mile Studio Zone (pre-production through strike). Eligible expenditures include qualified wages paid for services performed outside the Zone, and expenditures purchased or leased and used outside the Zone.

Visual Effects: To qualify, visual effects work must represent at least 75% of the VFX budget or a minimum of $10 million in qualified VFX expenditures incurred in California.

Local Hire Labor: Non-independent productions (except for Relocating TV) are eligible to receive an additional 10% tax credit for qualified local hire labor. Independent films and relocating TV series are eligible to receive an additional 5% tax credit for qualified local hire labor.

When Can I Apply?

Eligible productions may submit an application via the online application portal during specific application windows.

When Can I Apply?

Eligible productions may submit an application via the online application portal during specific application windows.

Jobs Ratio Ranking

Submitted applications are approved via a Jobs Ratio Ranking – a process to identify projects most likely to increase jobs and economic activity in the state.

Jobs Ratio Ranking

Submitted applications are approved via a Jobs Ratio Ranking – a process to identify projects most likely to increase jobs and economic activity in the state.

How do I apply as an Indie Producer?

Several resource materials, including Frequently Asked Questions, are available to independent and non-independent applicants.

How do I apply as an Indie Producer?

Several resource materials, including Frequently Asked Questions, are available to independent and non-independent applicants.

California Film Commission

7080 Hollywood Blvd., Suite 900

Los Angeles, CA 90028

Tel: 323.860.2960 | 800.858.4749

Email the CFC | About Us

Stay Informed! Sign Up:

Newsletters

Production Alerts

Soundstage Alerts

CFC Board Notices Sign-Up

Careers

Download the Cinemascout app!